International Payments Without The Hassle

Receive Global Payments with

Our All-In-One Platform

Global Accounts

Your Gateway to Global Markets

Manage multiple currencies with global virtual accounts - Inward remittance at 0.75%+GST

What is a Global Virtual account?

What is a Global Virtual Account?

A global virtual account is like a digital wallet for your business, making it simple to send and receive payments worldwide.

You need a virtual account for each specific currency you plan on making transactions in through the BRISKPE app

Payment Links

Safe & Secure International Payments

Receive payments through cards and PayPal Wallet via links.

Show pricing

Pay As You Go Pricing

- Transparent Pricing

- Business-friendly Rates

- No Setup Fees

- No Hidden Charges

Payment Link (International Cards)

Payment Link (International Cards)2.75% + 18% GST

Show pricing

Pay As You Go Pricing

- Transparent Pricing

- Business-friendly Rates

- No Setup Fees

- No Hidden Charges

Payment Link (International Cards)

Payment Link (International Cards)2.75% + 18% GST

Marketplace

Expand Your Reach with Amazon Global Selling

Access new markets and customers worldwide.

Platform

White-Label Payment Solutions

Integrate BRISKPE's payment solutions, with your own brand.

PayPal

Expand Your Payment Options with PayPal

Access new markets and customers worldwide.

Payouts

Reliable Cross-Border Transfers

Ensure timely payments to your global network.

RBI Approved • PA-CB Authorised • Powered by leading partners

Flat 0.75%*

Transaction Fee for

All Global Payments

See exactly how much you'll receive with our competitive exchange rates.

*GST Applicable

₹ 83.75

(+GST)

By , you will receive

Within 24 hours

Within 24 hours  INR

INR See how much you can save annually with BRISKPE

Your first transaction is FREE — Get 100% cash back on the transaction fee on your initial payment.

Find the Right BRISKPE Solution for You

Select what describes you the best

Freelancer

MSMEs

Amazon Seller

Service Provider

80%

More Savings

5x

Faster Transactions

80%

More Savings

5x

Faster Transactions

20%

More Savings

2x

Faster Transactions

80%

More Savings

5x

Faster Transactions

Security is Our Top Priority

Advanced fraud protection, rigorous security features, and 24/7 in-app customer support!

Protected by 2 factor authentication and multiple layers of security.

Secure payments, fully compliant with RBI and FEMA regulations.

ISO 27001 & SOC 2 Type II certified – top-tier data security, guaranteed.

END TO END PAYMENT INFRA BACKED BY

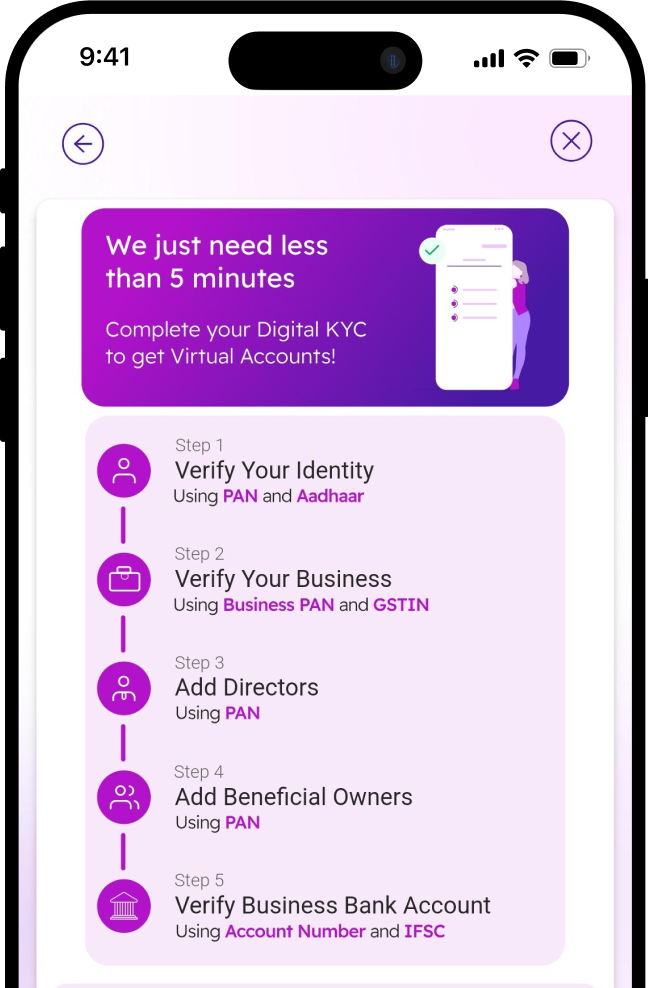

Quick & Easy: Setup Your Global Account In 5 mins!

Have your PAN & Aadhaar cards ready before you get started.

Time to make it happen?

- Login in to our web portal or download our mobile app

- Start the timer and set up your global account in 5 mins.

You’re all set!

Start receiving payments with BRISKPE.

Verify your mobile number to create an account.

Choose your type of account

as well as your currencies.

with our secure system.

Your virtual accounts are

ready for use!

Yet to get started?

- Login in to our web portal or download our mobile app

- Start the timer and set up your global account in 5 mins.

Streamlined Tools For

Your Business

Streamlined Tools For

Your Business

Quick Digital KYC

Secure digital KYC processes give you quick access to your accounts.

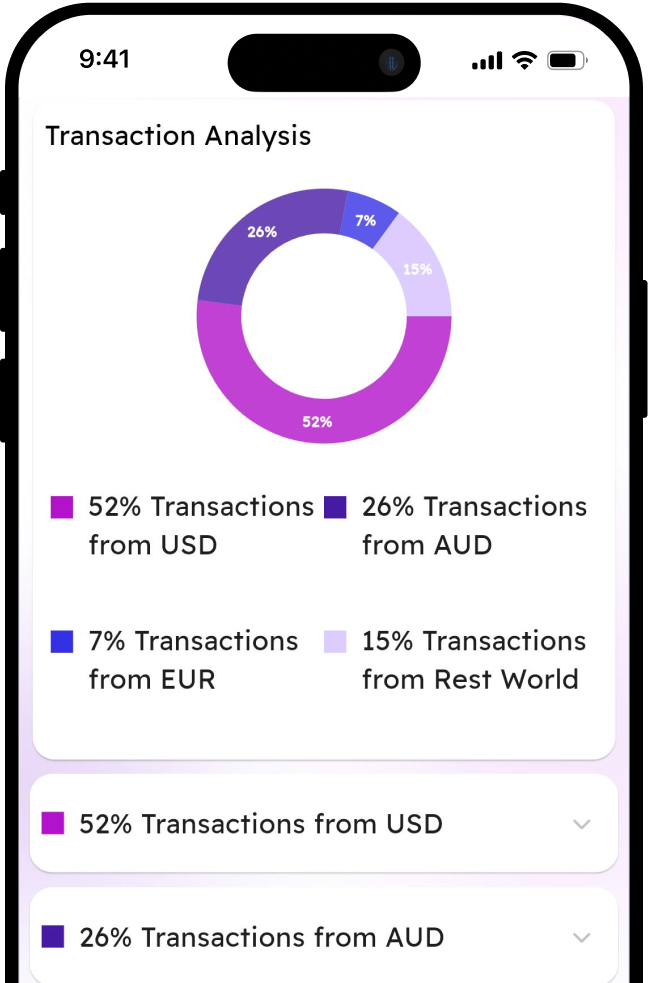

Powerful Business Analytics

Gain valuable insights into your global transactions and make informed business decisions.

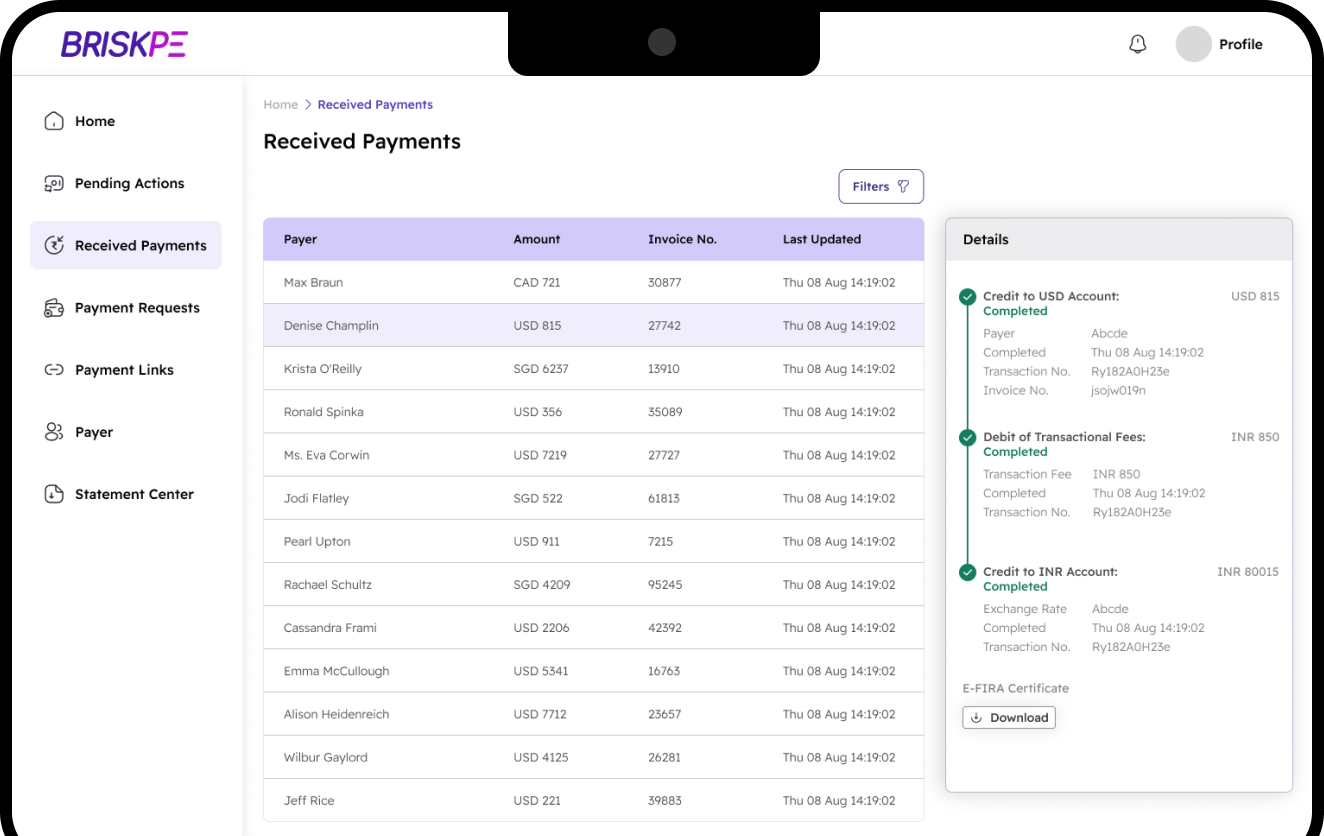

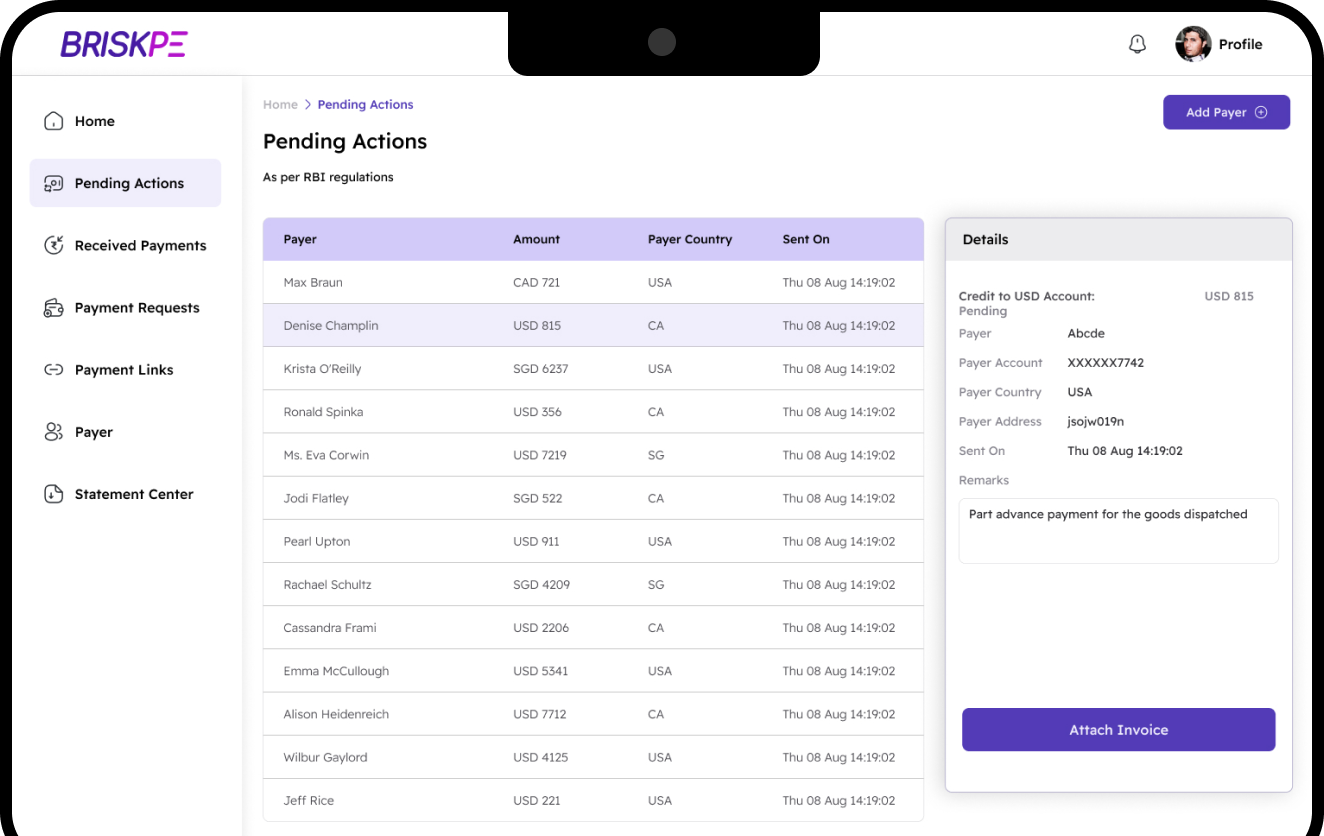

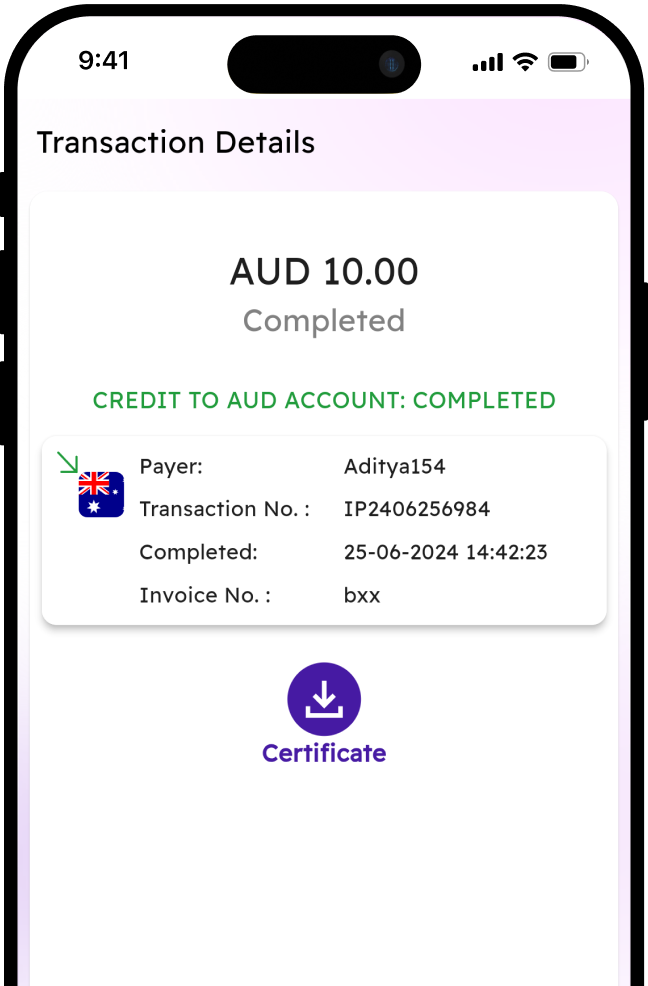

Track Payments

Easily track and follow the progress of your cross-border payments.

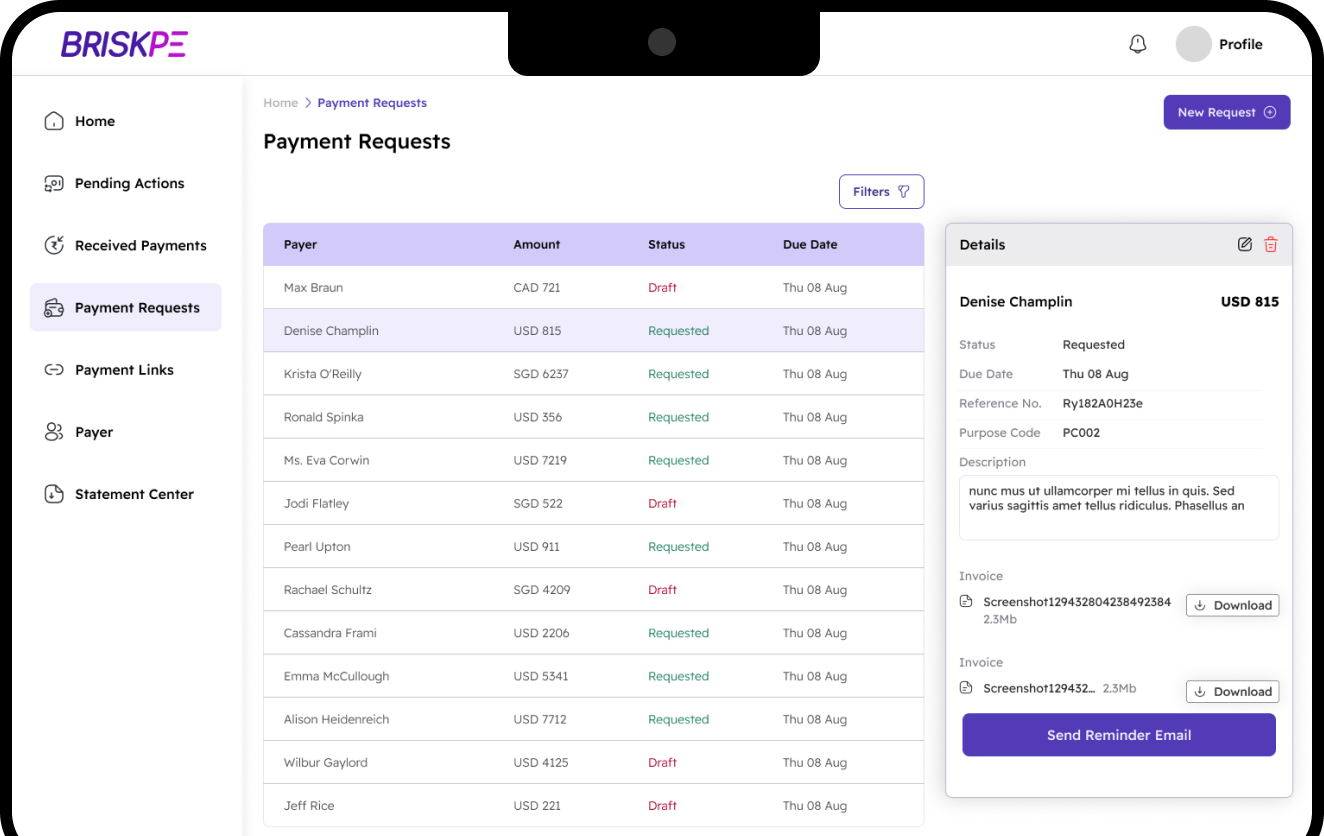

Manage Invoice With Ease

Send and manage invoices for international payments effortlessly.

Instant e-FIRA

Get your e-FIRA instantly for hassle-free compliance.

Send Timely Reminders

Effortlessly manage your invoicing and ensure timely payments.

Across Industries, Across Borders

Our platform handles transactions in diverse industries across India, helping them grow globally.

Web Developer

12% of services transactions on BRISKPE

Leather Exporters

15% of goods transactions on BRISKPE

Software Agencies

30% of services transactions on BRISKPE

Accessories Exporters

11% of goods transactions on BRISKPE

Home Decor

22% of goods transaction on BRISKPE

Consultancies

16% of services transactions on BRISKPE

Digital Agencies

14% of service transactions on BRISKPE

Textile Exporters

32% of goods transactions on BRISKPE

Passionate About Solving For People, Like You

- 69%

- Reduction in Transaction Charges.

Gautam Khandelwal

- Naturopathy Consultant

- 23%

- Profit Boost

Sameer Choudhary

- RCM Service Provider

- 47%

- Faster Settlement

Manish Modi

- Co-founder/Director, Hair Originals

- 31%

- Cost Saving

Hemant Ghiya

- Oliveto India LLP, Partner

- 23%

- Profit Boost

Leena

- RCM Service Provider

Frequently Asked Questions

BRISKPE charges 0.75% + GST transaction fee on the total amount transacted via A2A or virtual account payments. Plus, your first transaction on the BRISKPE platform is free, with 100% cashback on the transaction fee.

Also, please note that we’ve updated our fees and settlement timelines from July 10, 2025:

New Fees:

- Min: ₹500 (incl. GST)

- Max: 0.75%+GST*

Settlement Time:

-

- Below $200: T+3 days

- Above $200: T+1 day (unchanged)

However, the pricing for payment links may vary depending on the provider:

- PayU: 2.75% of the transaction value + 18% GST.

- PayPal: 4.4% of the transaction value + 18% GST + Forex charges + 30 cents per transaction.*Please note that pricing may vary for high-risk segment clients

Yes, there are limits on transaction values. Exporters of goods and services can transact up to INR 25,00,000 per unit (or its equivalent in other currencies) in accordance with the RBI’s Payment Aggregator and Cross-Border (PA-CB) guidelines.

Setting up your BRISKPE account is simple. Start by registering with your mobile number, and in just 5 minutes, you can complete the KYC process. To get onboard, you’ll need a few key documents: the PAN and Aadhaar numbers of the Director/Partner/Proprietor, along with business documents like the entity’s PAN, the PAN of the Director/Partner/Beneficial Owner, and the entity’s bank details. With these in hand, you’ll be ready to go in no time!

Yes, now you can simplify your payment process by connecting your BRISKPE account to PayPal or PayU and using the payment link option. This makes it easier for both you and your clients, as they can conveniently pay via card payments as well. It’s a streamlined solution for faster and more efficient transactions.

Yes, the BRISKPE platform is specifically designed to meet the needs of business owners, sole proprietors, and freelancers. If you are a service provider exporting services internationally, BRISKPE offers an efficient and streamlined solution to manage and receive payments.