PayPal is a widely recognized and used international payment platform for online transactions outside India. However, many Indian exporters avoid using PayPal because of its high fees, even though overseas clients often prefer it. This difference in preference can leave one side feeling unhappy with the payment method chosen.

To bridge this gap and serve Indian exporters better, BRISKPE is integrating with PayPal. This makes it easier for exporters to handle all their cross-border payments on a single platform. While BRISKPE makes it easy to handle your PayPal transactions, let us first understand how to set up a PayPal account.

How to link your PayPal account with BRISKPE?

The process of linking your PayPal account to BRISKPE is simple-

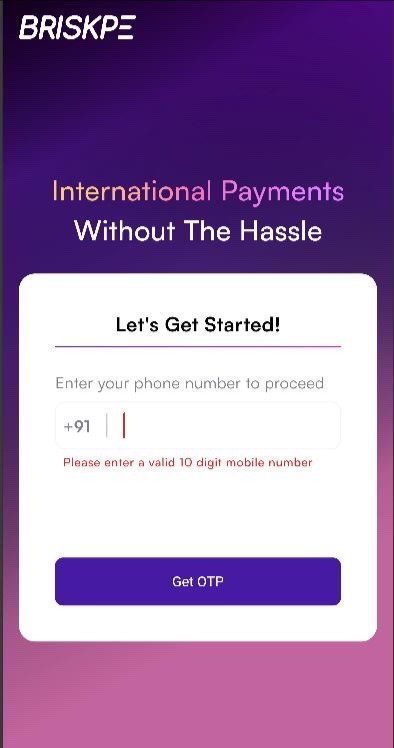

Step 1: Log in or sign up

If you have a BRISKPE account, simply log in using your mobile number. If you’re new to BRISKPE, you can sign up quickly by providing a few key details. The onboarding process is smooth and takes just about 5 minutes.

For a step-by-step guide on how to get started, click here.

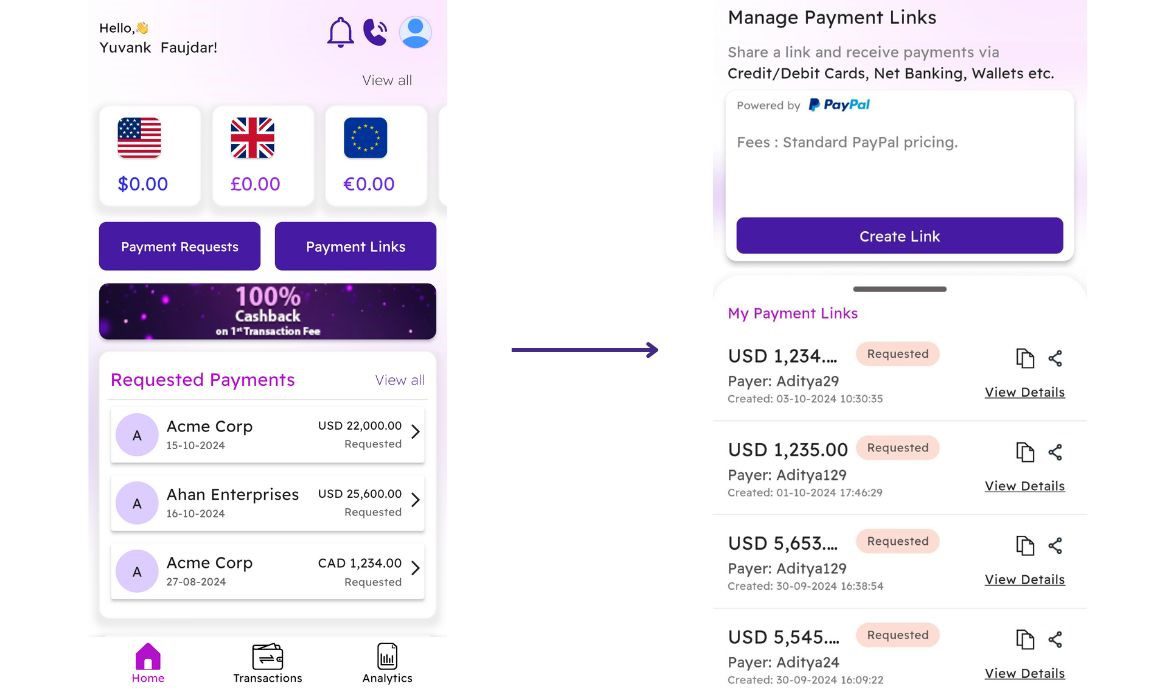

Step 2: Navigate to ‘Payment Links’

On the homepage, go to the ‘Payment Link’ section and click on it. A new page will open where you can select the ‘Create Link’ option under PayPal.

Note that the payment link option varies based on your account type. Freelancers and sole proprietors will have access to the PayPal payment link, while businesses can choose between PayPal and PayU for greater flexibility.

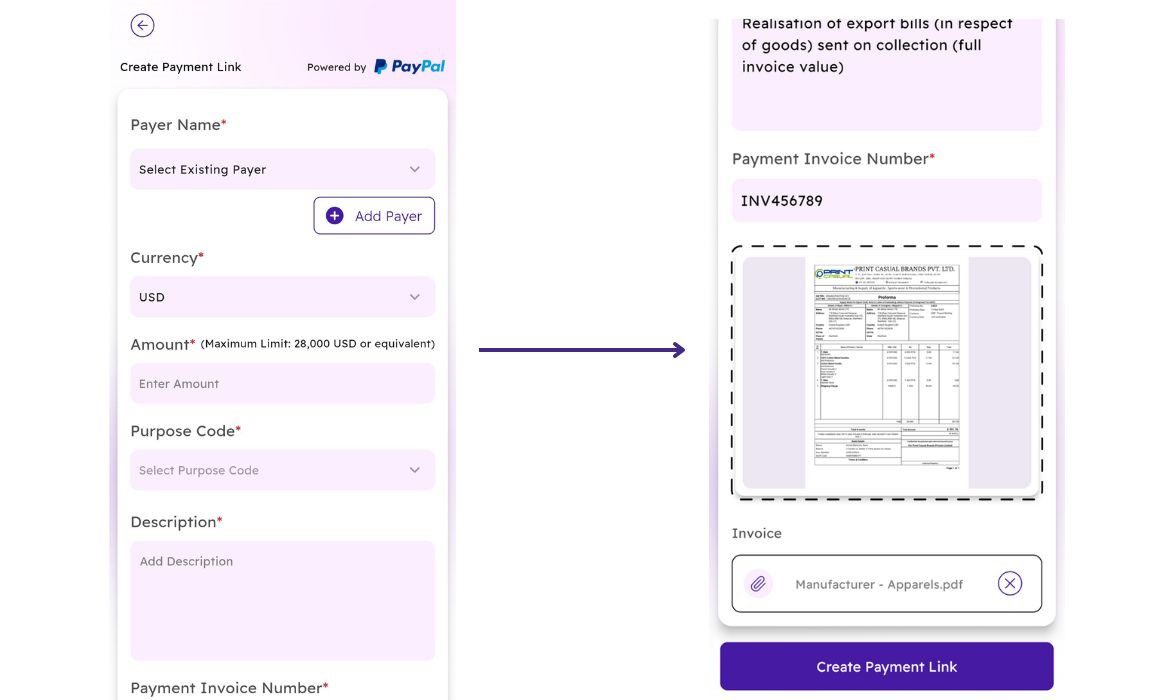

Step 3: Add details to create ‘Payment Link’

Upon clicking on the create link option, you would need to enter all the necessary information required like payer’s name, currency, amount, purpose code, description, and invoice. Once you have filled in all the correct information, press the ‘Create Payment Link’ option to create a link and your link will be generated instantly.

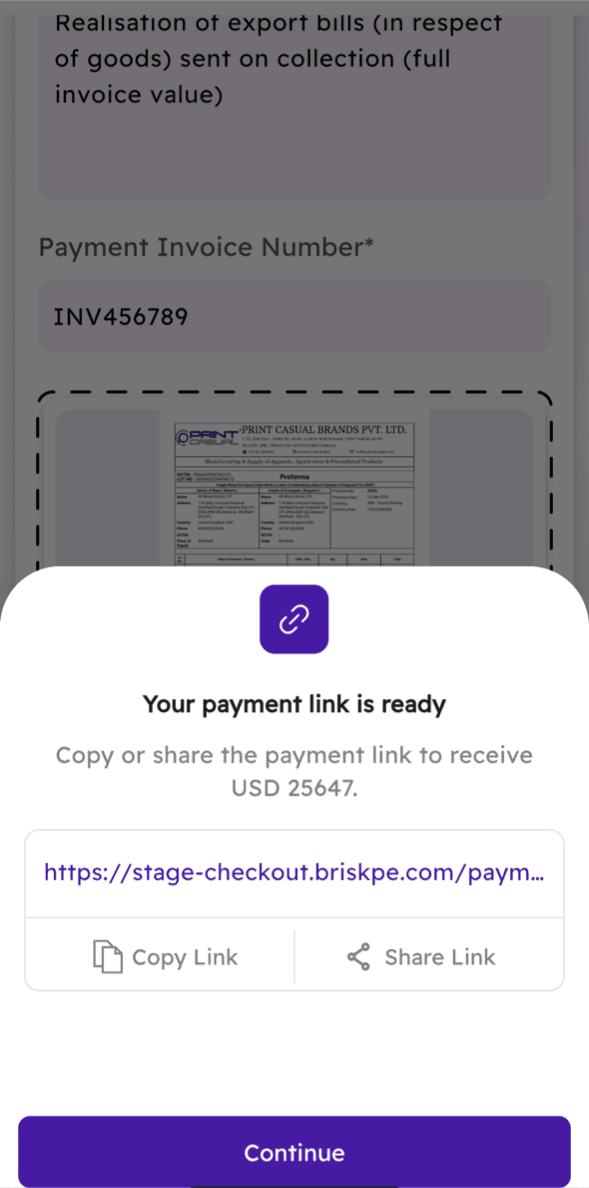

Step 4: Share your payment link

Once the payment link is generated, you can either share it directly with your customer or copy the link to send via your preferred messaging platform. The customer can then click the link and complete the payment using their credit or debit card.

How do you receive payments via PayPal?

If you want to receive payments via PayPal, all you need to do is share the PayPal payment link you have generated on our app/ web portal with your customers. Your customers can make payments via credit or debit cards, and you’ll receive a notification once the amount is credited to both your virtual and Indian bank accounts.

Alternatively, you can also copy the payment link and share it with your customers via text, email, or social media.

How does PayPal work with BRISKPE?

BRISKPE offers you a range of payment options, including PayPal, A2A transfers, and card payments, all in one place. With this integration, exporters can offer clients the flexibility of choosing their preferred payment method – whether it’s a virtual account transfer, card payment, or PayPal wallet – through BRISKPE.

Benefits of using PayPal with BRISKPE

There are several benefits of using PayPal with BRISKPE, some of them are-

- Offers flexibility to clients: With the help of PayPal-BRISKPE integration, you will be able to provide your customers with multiple payment options including credit/ debit card payment option.

- Online transactions under one-roof: Regardless of the payment method, you will be able to handle all your transactions from the BRISKPE dashboard.

- Unlimited payment link creation: You can create unlimited payment links according to your flexibility and convenience.

- Faster payments: The payments will instantly reflect in your virtual account and will be reflected in your bank account in T+2 days.

Conclusion

PayPal, even being a popular platform, has its pros and cons. But BRISKPE’s integration with PayPal offers your clients a smooth, hassle-free experience while allowing you to manage multiple payment options with transparent fees. Start your journey with BRISKPE today and unlock the potential of streamlined international payments.