Customer Grievance Redressal Policy

Updated on 09 May 2025

The policy has undergone changes pursuant to issuance of Payment Aggregator-Cross Border guidelines issued by Reserve bank of India (RBI/2023-24/80 CO.DPSS.POLC.No.S-786/02-14-008/2023-24). Hence PA-CB shall be read as Payment Aggregator-Cross Border (PA-CB) for the purpose of this document.

Introduction

GoBrisk Technologies Private Limited (hereinafter referred to as ‘BRISKPE’) incorporated on

February 21, 2023, is a Mumbai-based financial services technology startup.

BRISKPE has set up a strong system for addressing complaints and grievances, allowing Users

to seek redress swiftly and efficiently for their concerns. The primary goal of our grievance

redressal policy at BRISKPE is to deliver timely and comprehensive resolutions to customer

complaints, queries, and grievances. This policy is designed to encompass critical aspects,

including the disposal of complaints, handling of grievances, management of chargebacks,

and processing of refunds.

BRISKPE has put in place a Grievance Redressal Policy (the ‘Policy’) duly approved by the

Board of Directors encompassing the requirements emanating from the following guidelines:

- Guidelines on Regulation of Payment Aggregators and Payment Gateways, 2020.

- PA-CB Regulations.

- Harmonisation of Turn Around Time (TAT), 2019.

- Integrated Ombudsman Scheme, 2021; and

- Online Dispute Resolution (ODR) for Digital Payments, 2020.

For the convenience of all stakeholders, BRISKPE has made the Grievance Redressal Policy

accessible on its website/ mobile application along with the details of the Nodal officer.

Additionally, BRISKPE has also displayed Frequently Asked Questions (FAQs) on its website/

mobile application for ease of reference to its Users.

Key Definitions

The key definitions for the purpose of this Policy are as follows:

- Customer/ User/ Complainant: Refers to individuals or entities utilising the payment solutions provided by BRISKPE and raising concerns or complaints regarding the services rendered.

- Complaint/ Grievance: Any dissatisfaction or complaint raised by a User concerning the services provided by BRISKPE, including but not limited to transaction-related issues, service related concerns, etc. Please note, communications meant to provide suggestions, feedbacks, queries or clarifications, won’t be considered as instances of complaints or grievances.

- Nodal Officer: A designated individual appointed by BRISKPE to oversee the grievance redressal process, coordinate with relevant departments, and ensure timely resolution of grievances as per the established procedures.

- Unique Ticket Number (UTN): A unique identifier assigned to each User complaint upon registration, facilitating tracking and monitoring of grievance resolution progress by both the User and BRISKPE.

Objectives

The primary objectives of the Grievance Redressal Policy are:

- To provide Users with equitable, unbiased, and fair treatment.

- To address all User-related concerns within prescribed timelines.

- To maintain the fundamental principles of integrity and transparency.

- To protect Users from fraudulent activities, deception, or unethical conduct.

- To educate Users about the available avenues and escalation procedures for grievance resolution if they are not satisfied with the resolution.

- To continually enhance our service quality based on regular evaluations of the grievance resolution framework; and

- To prevent the occurrence of similar complaints in the future.

Grievance Redressal Mechanism

BRISKPE’s Grievance Redressal Mechanism is designed to encompass accessible modes for complaint registration, escalation matrix, turn-around time for grievance redressal, etc.

The principal elements of BRISKPE’s mechanism for resolving complaints/ grievances are detailed below:

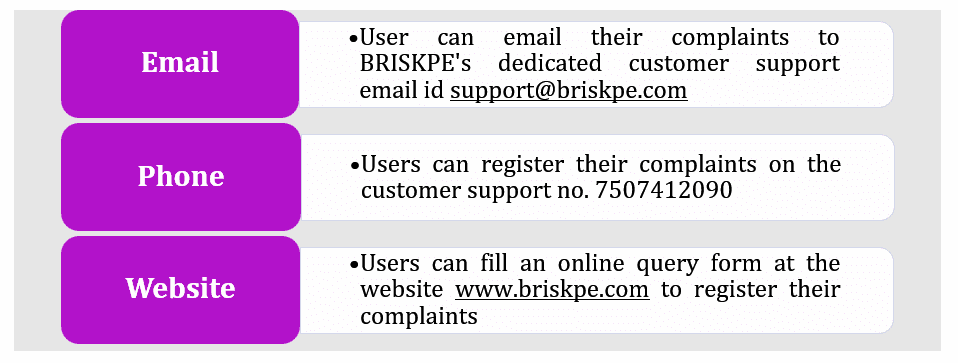

- Complaint Registration: Channels for Complaint Registration

|

|

| Phone |

|

|

|

| Website |

|

- Acknowledgement: BRISKPE will send an acknowledgement email to the complainant within 24 hours of receiving a complaint.

- Tracking of Complaints: BRISKPE will assign a Unique Ticket Number (‘UTN’) to each complainant with the acknowledgement email. The UTN will be used by the complainant to check the status of the resolution on any of the aforementioned channels. In addition, the Customer Support Team will keep the complainant updated on the progress and status of the complaint/ grievance periodically until resolution.

- Monitoring and TAT for Complaint Resolution: Complaints will be monitored regularly for resolution within a time-bound manner, ensuring timely updates are provided to the complainant. Further, complaints will be marked as closed only after resolution. BRISKPE will ensure that complaints are disposed of within 30 working days of its receipt.

- Response to disposal of complaints: BRISKPE will provide detailed reasons via email for the resolution or rejection of the complaint.

- Appointment of the Nodal Officer: BRISKPE has a designated Nodal Officer responsible to encompass managing regulatory and grievance redressal functions. BRISKPE’s website features the particulars of the appointed Nodal Officer.

Handling of Grievances

- Customers can write to us using an online query form at www.briskpe.com to register their complaints.

- A unique ticket number is assigned for each query or complaint, and customers an email communication.

- Customers can register or track their queries on [email protected]

- In our tiered approach for grievance resolution:

| Level | Responsible Person | Mode | TAT |

|---|---|---|---|

| Level I | Customer Support |

|

Resolution within 2 working days |

| Level II | Nodal Officer |

|

Resolution within 7 working days. |

Filing a Complaint with the Integrated Ombudsman

If complaints remain unresolved after reaching Level II, Users have the option to approach

the RBI Integrated Ombudsman under the ‘The Reserve Bank – Integrated Ombudsman

Scheme, 2021.

Address:

Centralized Receipt and Processing Centre,

4th Floor, Reserve Bank of India,

Sector -17, Central Vista, Chandigarh – 160017

Centralized Receipt and Processing Centre,

4th Floor, Reserve Bank of India,

Sector -17, Central Vista, Chandigarh – 160017

Email:

[email protected]

[email protected]

Record Maintenance

BRISKPE maintains a comprehensive record of all complaints,

encompassing details about the nature of the complaint, the actions undertaken for its

resolution, and the corresponding timelines.

Turn Around Time (TAT) for resolution

The indicative TAT for the resolution of certain types of complaints are outlined below:

| Type of Complaints | TAT Resolution |

|---|---|

| Onboarding / Registration | Within 4 working days |

| Change in Businesses / Merchant information including KYC | Within 2 working days |

| Enquiry about transaction status | Within 2 working days |

| Settlement not received | Within 2 working days |

| Beneficiary did not receive the payment | Within 2 working days |

| Refunds / Returns | Within 5 working days |

| Chargeback | Within 7 working days |

| On Hold Transactions | Within 2 working days |

| Failed transactions | Within 2 working days |

| Transaction successful, but services not delivered | Within 4 working days |

| Transaction successful & services also delivered, but the user is not satisfied with the product/services | Within 4 working days |

| Fraudulent activity | Within 1 working day |

Note: The aforementioned TAT depend on prompt responses from any involved third parties,

such as Merchants, payment service partners, etc.

Settlement Process

- All inward transactions for a customer should be permitted as per the regulatory guidelines for exports and imports of goods and services.

- All the pending transactions which require additional documents for processing shall be shown to customers after login to BRISKPE’s app or web portal. BRISKPE shall make attempts to send automated/service-initiated reminders to customers.

- All inward transactions, subject to satisfactory compliance requirements, shall be settled within 5 working days.

- In the event the customer fails to provide the necessary underlying transaction details i.e. the underlying invoice, shipment/delivery details, Goods/Service Contract copy to ascertain Genuity of the transactions, shall be marked for return to the remitter after 5 working days.

- The Compliance Team reserves the right to reject and return the processing of any transaction if operations/compliance team ascertains that transaction is outside risk appetite of BRISKPE. Customers shall be informed by way of mail such rejections/return.

Disposal of Complaints

Customer Complaint Management Process:

- We have implemented a systematic process for tracking and promptly resolving customer complaints at BRISKPE.

- Our objectives include ensuring adequate complaint responses, acceptable response times, complaint closure, and continuous analysis of trends for improvement.

- Complaints are monitored for resolution within a time-bound manner with regular updates provided to the customer.

- Targeted Turn Around Times (TATs) for responses are managed within 2 working days, and resolutions within 7 working days from the date of receipt.

- Customer queries, when service-led deficiencies are identified, are categorized as complaints, and resolved according to the following table:

| Customer Queries | Resolution |

|---|---|

| Enquiry about transaction status or payment | Transaction details and payment status provided |

| Charge related | Information on charge with a detailed breakup is provided |

| Buyer Payment not reflecting on app | Receipt status is verified with the concerned bank or payment provider |

| Credit not reflecting in customer’s account | Credit status verified with the concerned bank or payment provider |

| Mismatch Credit and FIRA Amount | Details of all inward, necessary charges and deduction provided |

| Return/Refund related |

|

Management of Chargebacks:

1. Chargebacks, the reversal for local payment methods/SWIFT transactions initiated by

customers, are managed comprehensively at BRISKPE as per the Master Direction –

Export of Goods and Services; Master Direction -Import of Goods and Services

2. Types of chargebacks and associated remedies are clearly defined.

| Chargeback Reason | Description | Remedy |

|---|---|---|

| Merchandise not received | Claims of non-provided services or undelivered goods |

|

| Duplicate Processing/ Paid through other means | Payer cancels transaction: refund or credit is due |

|

| Account debited but confirmation not received | Dispute of payment made but not credited: transaction has failed | Provide confirmation of no credit to BRISKPE |

| Goods not as described | Claims that merchandise doesn’t match website/Email/Product Template description | Raise dispute with seller as per UCP under laws of ICC |

| Return/Refund related | For cases where transaction has been rejected by compliance the customer | shall be returned to remitter and an email shall be provided to |

3. For Account-to-Account payments, Chargeback request processing is subject to availability of funds in the collection A/C

4. For Card payments, BRISKPE Chargeback Management System shall oversee dispute stages and participant access (To be developed before product launch).

5. Roles and responsibilities are defined by collection rails providers/bank’s guidelines for appropriate dispute resolution.

6. Dispute resolution process includes obtaining supporting documents, resolving disputes, and final resolution based on bank’s/payment rail’s decisions.

Processing Refunds

- Refunds, originating from various scenarios, are efficiently handled at BRISKPE.

- Refunds initiated by merchants processed within payment service provider/Bank’s timelines.

- Daily reconciliation is conducted with payment service providers and banks to identify failed transactions and report them accordingly.

Review of Policy

BRISKPE will review the Policy at least annually or earlier, if required, considering any material changes in regulatory framework or for business or operational reasons. Any subsequent changes will form part of the Policy after the approval of the Board.

Contact Us and Details of Grievance Officer

We understand that you may have questions about this Privacy Policy, on how we process or handle your Customer Information, or may otherwise want to understand these aspects. We welcome you to reach out to us with your queries, grievances, feedback, and comments at