In the world of global transactions, exporters and freelancers rely on traditional services like banks which often charge high transaction fees and credit processing time. To solve this problem, platforms like BRISKPE are providing international virtual accounts in under five minutes.

What is an international virtual account?

An international virtual account is referred to as a digital banking solution that allows businesses and freelancers to receive payment in multiple currencies. In simpler words, you can receive international payments without needing a physical bank account in each country.

A virtual account is designed specifically for international transactions and allows you to conduct cross-border transactions hassle-free. Using one platform, you can accept payments from clients around the world, convert currencies at favourable rates, and streamline your accounting processes. Your accounting processes can be streamlined, currencies can be converted at favourable rates, and payments can be received from around the world.

Benefits of an international virtual account

With the help of a virtual account, there are various benefits a goods & service exporter can enjoy. Some of them are-

- Cost-effective transactions

Banks usually charge high fees such as currency conversion fees, and wire transfer fees. Whereas virtual accounts help in saving money with lower transaction fees.

- Faster payments

While the traditional method of banking can take more time to credit your payment, a virtual account can do it much faster (within 48 hours). This can also help you manage the cash flow of your business.

- Multi-currency support

A virtual account can be made for various currencies that can help you cater to a wide range of clients without the hassle of currency conversion.

- Simplified accounting

Managing multiple international bank accounts can be inconvenient. Thus, various virtual accounts under one roof can make your accounting simpler and more efficient.

How to create an international virtual account with BRISKPE?

BRISKPE has made the process effortless by providing you with an international virtual account in under 5 minutes. Here are the steps that you can follow to create your international virtual account for multiple currencies-

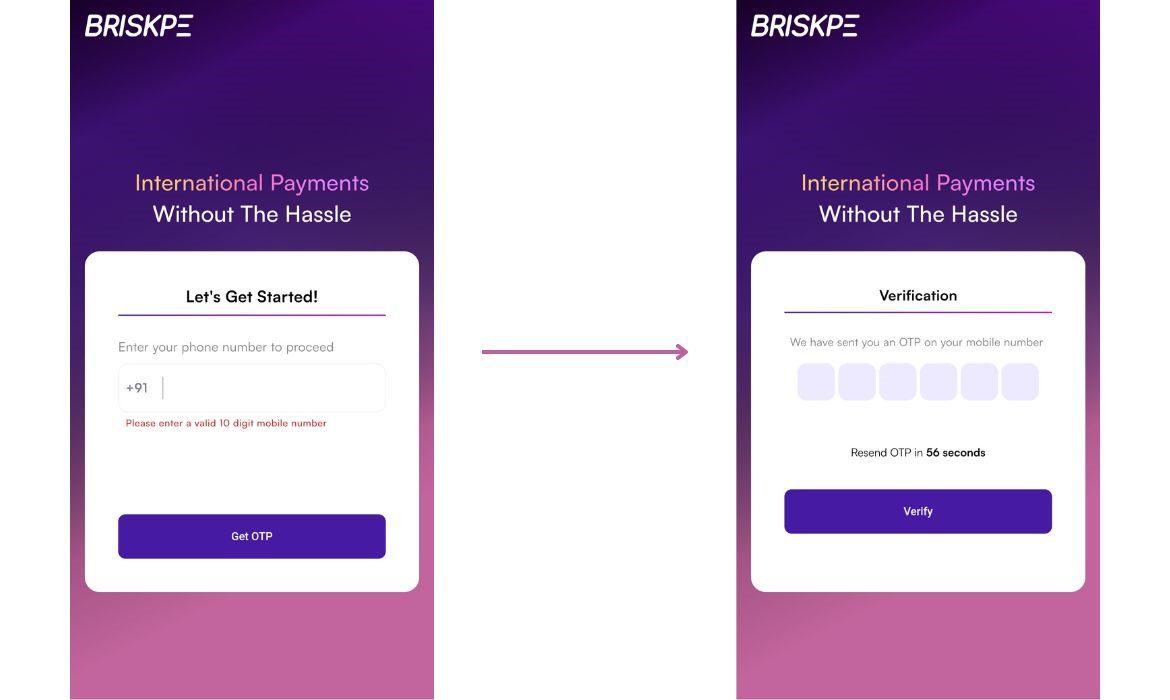

Step 1: Visit the BRISKPE platform

The first step is to sign up on the BRISKPE platform. You can use our web portal or download our app on iOS or Android for signing up.

Step 2: Verify your mobile number

Once you visit the website or app, you will have to enter your mobile number. Press on the “Get OTP” button at the bottom of the page to receive an OTP and verify your number.

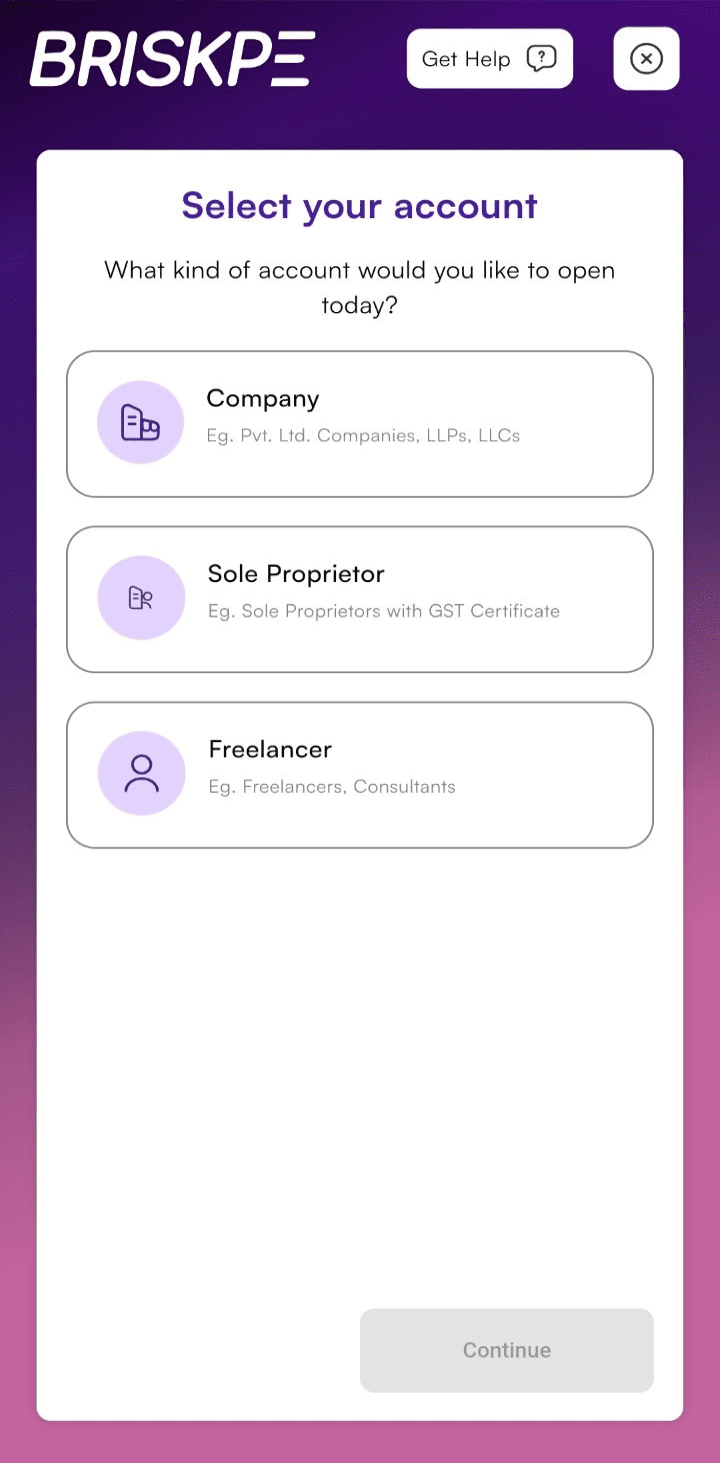

Step 3: Select your account type

On the next page, you will have to select your account type i.e., which account would you like to open. We offer you three options- company, sole proprietor, and freelancer. Press “Continue” once you select your preferred account.

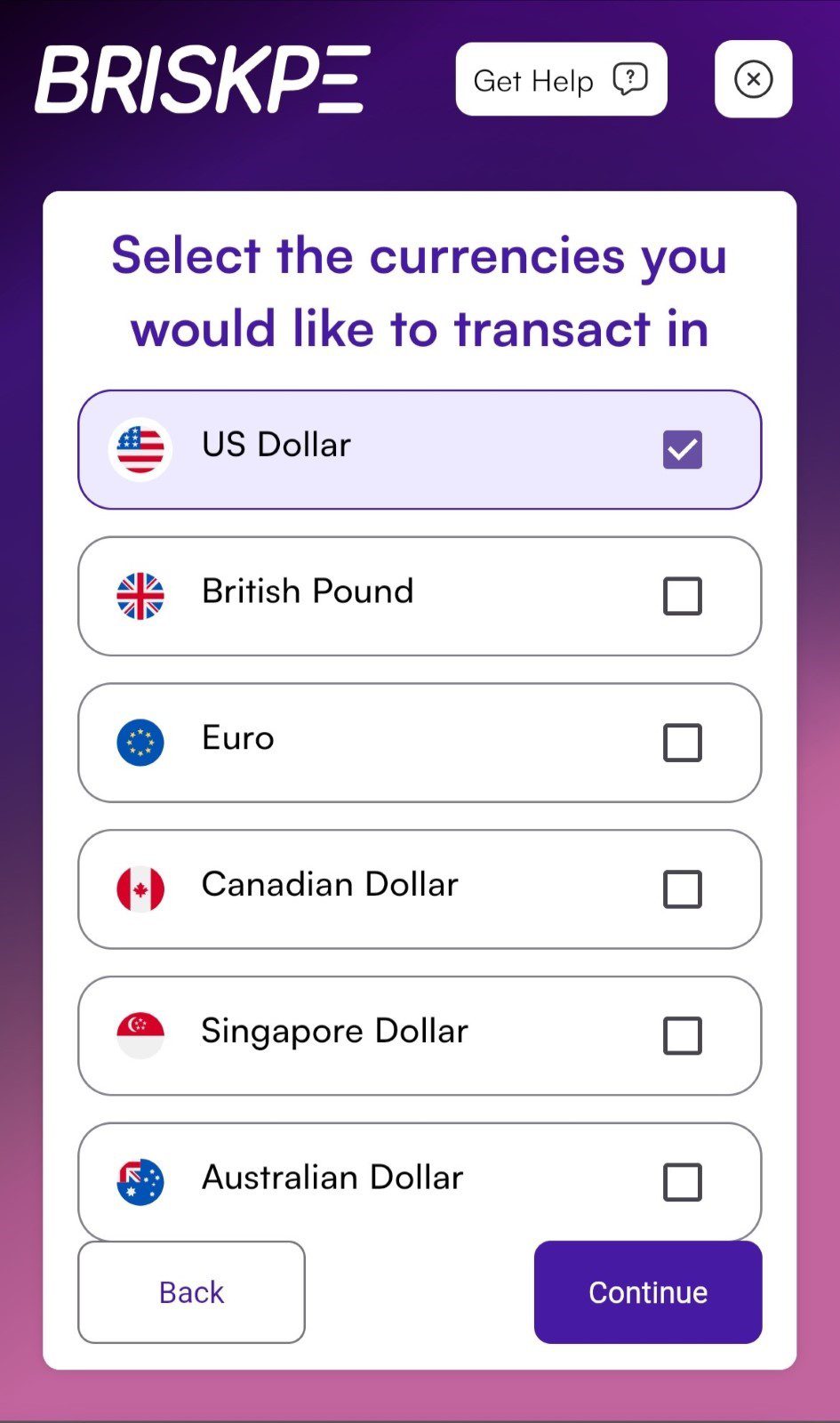

Step 4: Select your desired currency

We can help you receive payments in multiple currencies. You can select one or all depending upon your use case. To go to the next page, press “Continue”.

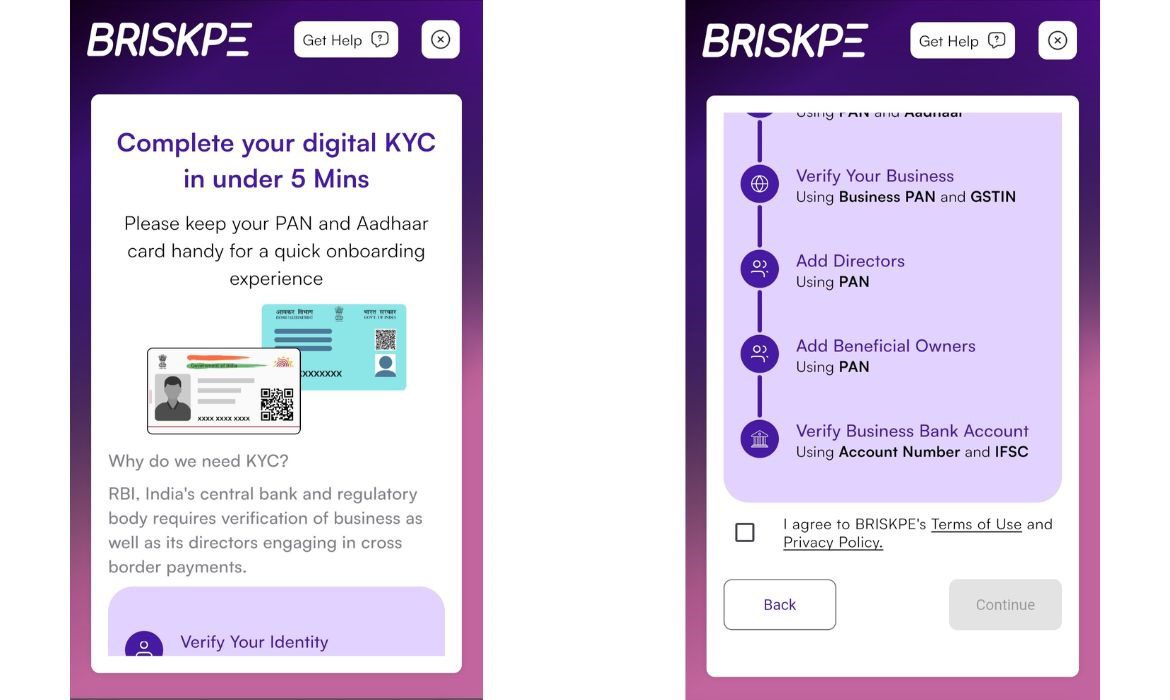

The next few steps are to complete your digital KYC in 5 minutes.

Step 5: Complete your digital KYC

For the digital KYC, we recommend you keep your PAN and Aadhar card. Scroll down below and check the privacy policy box and tap on “Continue”.

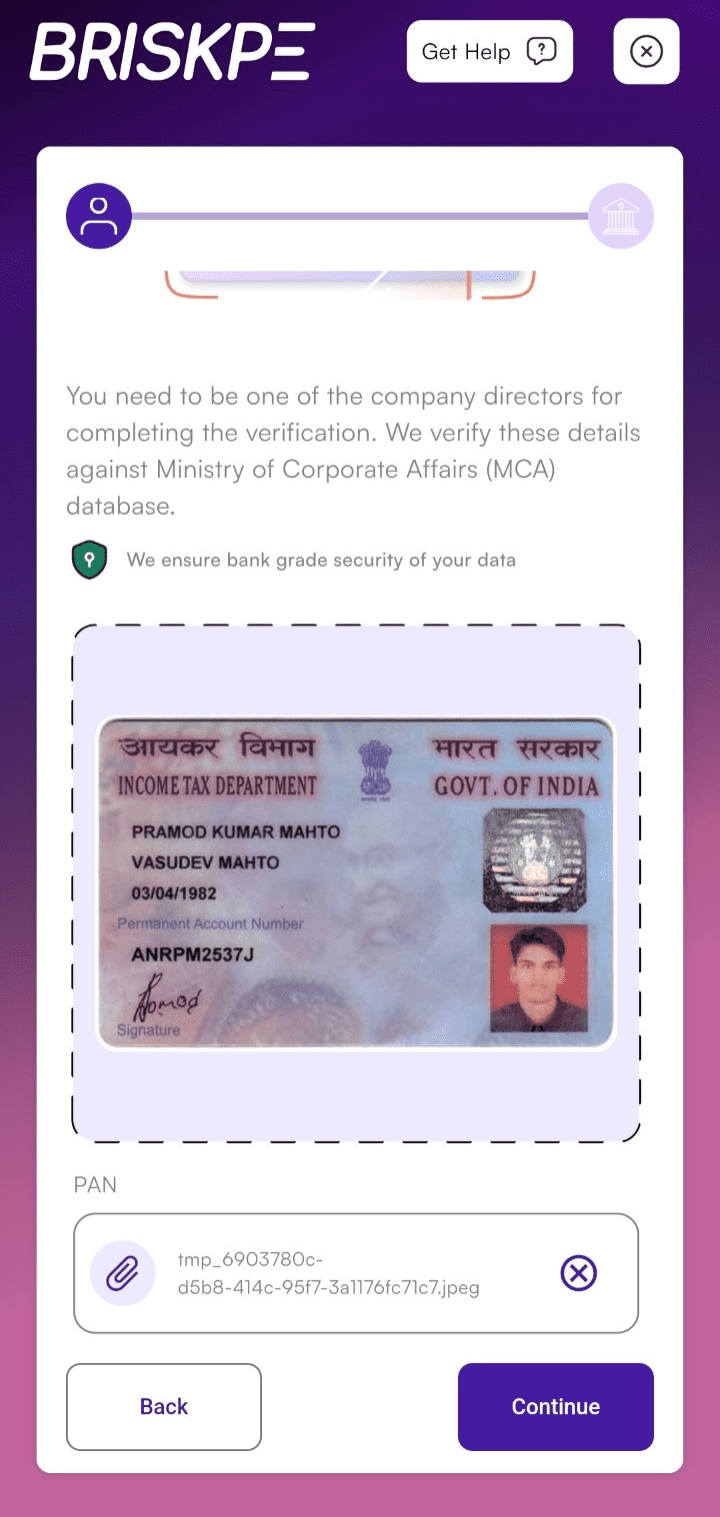

- Upload your PAN

On the next page, you need to scroll down and upload your PAN either by taking a picture or browsing from your gallery. Once uploaded, press “Continue”.

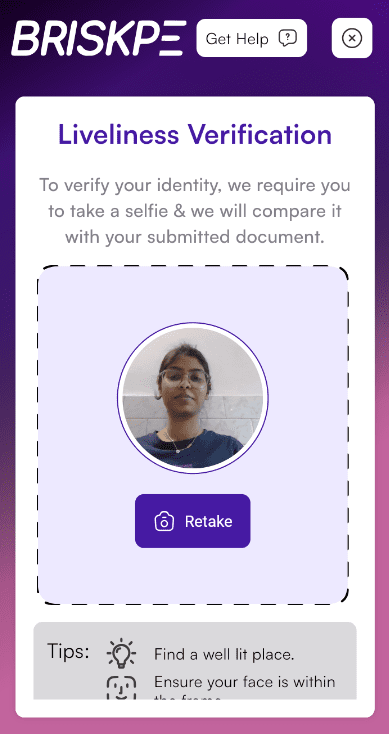

- Liveliness verification

In this step, you need to capture your live selfie for the system to determine that your PAN and selfie match.

- Verify your Aadhar card number

Enter your PAN card number, full name, email ID, Aadhar number, and a few more details to continue with the verification process.

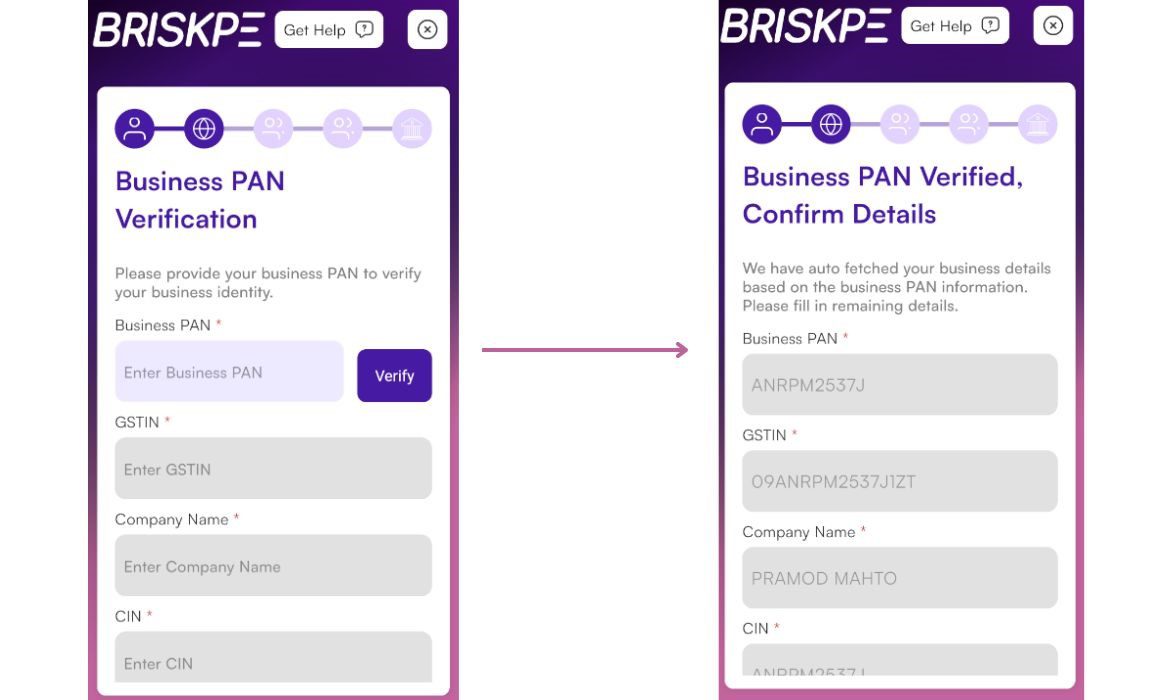

- Business PAN verification

You now must add your business details such as business PAN number, GSTIN, company name, CIN, etc. For verification.

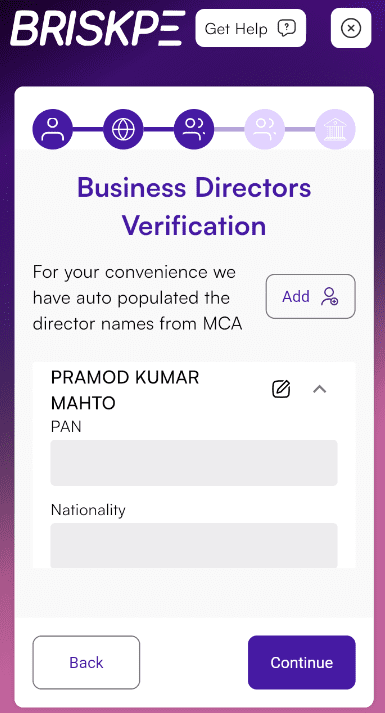

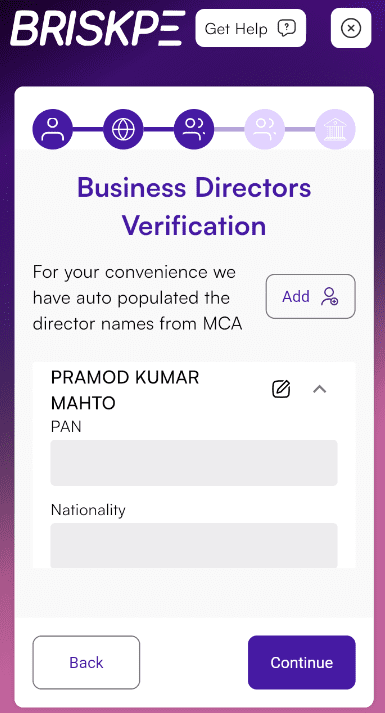

- Business directors’ verification

The director(s) of the business needs to verify their identity by entering their PAN card number and nationality one more time.

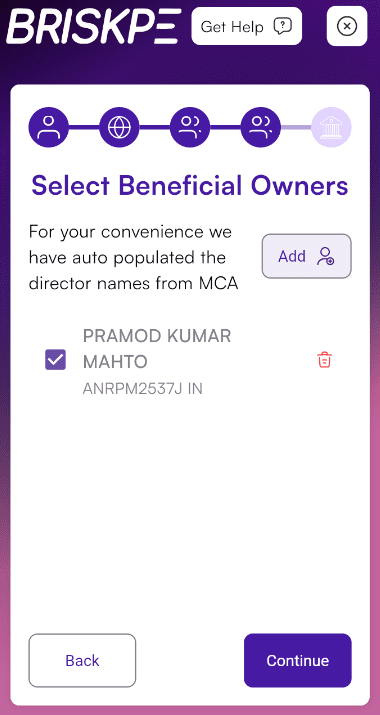

- Select beneficial owners

You can add one more beneficial owner in the next step. Select their names and press the “Continue” button.

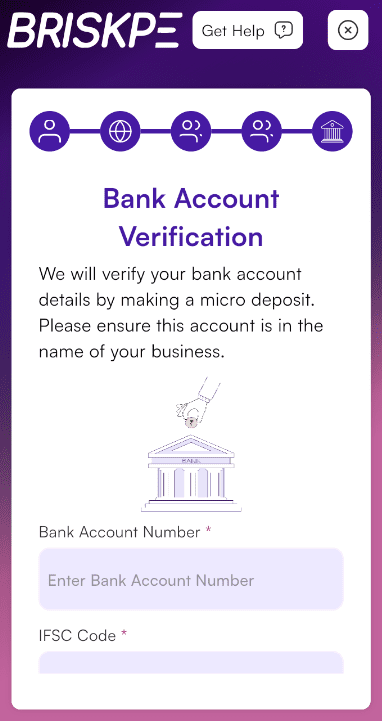

- Bank account verification

The last step is to add your bank account details such as account number and IFSC code to verify.

- Congrats!

You have successfully created an international virtual account. With the BRISKPE platform, you will be able to receive money in less than 24 hours and low transaction cost.

Note: If you select freelancer or sole proprietor as your account type, some of these steps may not apply.

How to log in to your profile?

Now that you have successfully onboarded, you will need to log in to your account using your mobile number. Follow these simple steps-

- Visit the website or app.

- Enter your mobile number.

- Enter the OTP you might have received on the same number.

- Press the “login” button to log in.

Conclusion

A virtual account with BRISKPE can simplify your financial operations. With just a few easy steps, you can set up an account that enables you to receive payment globally and reduces your transaction cost.

Choose BRISKPE today and start saving more on international transactions!