Freelancers, sole proprietors, and business owners are required to use a legal document for their business transactions. The two very common documents that most people use are invoices and proforma invoices. While these two look similar at first glance, they serve different purposes and are used in different contexts.

Let’s take a look at the difference between invoices and proforma invoices, which one to use in a certain situation, and how they can help you streamline your financial operations.

What is an invoice?

An invoice is a legal document issued by a seller to request payment from the buyer for the goods or services that have been delivered. They are usually sent after the completion of the goods delivered or service provided. This is essential for businesses to receive payments in time and maintain a smooth cash flow.

It should contain various information about the transaction, such as:

- A unique invoice number.

- The name, address, logo, and contact information of the seller.

- The name, address, logo, and contact information of the buyer/ client.

- A list of goods or services provided.

- The quantity along with the amount for each goods and service provided.

- The due amount including taxes.

- Details on when payment is due and accepted payment methods.

What is a proforma invoice?

Unlike invoices, a proforma invoice is not a document to request payment. Instead, it is a preliminary document that a seller uses to outline the expected cost of his/ her goods or services. In simpler words, it is a quotation or an estimated price given by the seller of goods or services based on which the buyer can decide whether to purchase them. They are widely used in international trade for buyers to get an idea of the cost before making the purchase.

A proforma invoice contains details to a commercial invoice but may have some additional information like:

- The issue date of the proforma invoice.

- A “valid till” date.

- A list of the items or services you agree to provide.

- Cost breakdown, including taxes, shipping, late payment charges, and other costs.

- Include the purchase currency on international invoices.

Also Read: What is an invoice and how to create one for international clients?

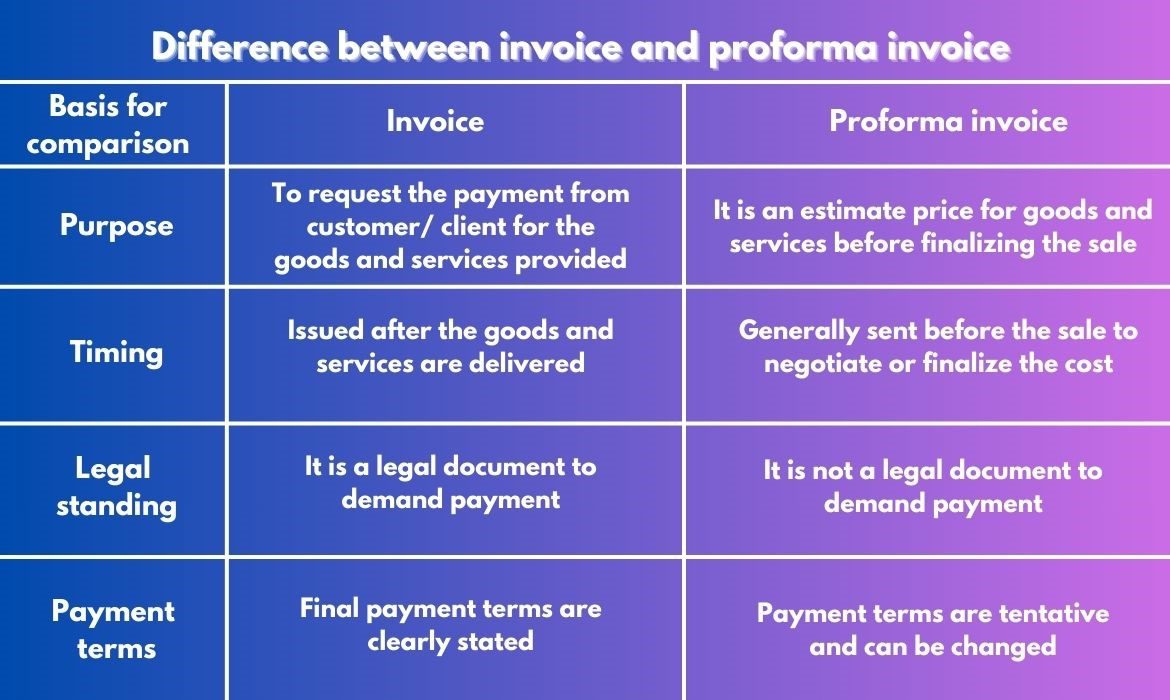

Difference between invoice and proforma invoice

To effectively provide your services and receive payments for the same, it is necessary to understand the difference between an invoice and a proforma invoice.

Purpose

Invoice: It acts like a bill for requesting payment after goods and services have been provided to the buyer/ client. Here, the buyer or the client is obliged to pay for the goods or services offered to them.

Proforma invoice: A proforma invoice includes an estimate or quote of the goods or service before the sale is finalized.

Timing

Invoice: They are issued after the goods and services are provided to the client.

Proforma invoice: It is created and sent to a potential customer/client before the sale, generally during the negotiation process.

Legal standing

Invoice: It is a legally binding document that can be used in court in case of payment issues.

Proforma invoice: It is not a legal document and does not demand payment.

Payment terms

Invoice: The payment due date, amount, and method are clearly stated in an invoice.

Proforma invoice: Payment terms are included but are tentative and can be changed.

When to use each document?

Knowing when to use invoices and proforma invoices is crucial for businesses and their financial operation.

Using an invoice

The invoice can be used by

eCommerce vendors: eCommerce vendors will send their invoice to the customer after shipping the product.

Freelancers: Freelancers can either send the invoice before delivering their service or after completion. They can also split the payment into two depending on their preference.

Small businesses: Business owners can send invoices to their clients to request payments for the goods and services provided by them.

Using a proforma invoice

One should use a proforma invoice to

Request for an estimated price of the goods or service: A proforma invoice includes the estimated price of goods and services that can help customers determine if they want to receive the service or not.

To show commitment to deliver goods or services: Asking for a proforma invoice suggests that the customer is serious about buying and you need to show your dedication to provide the goods or service.

Apart from these reasons, you can use proforma invoice to

- Declare the value of goods for customs purchase.

- When you don’t have the details needed for a commercial invoice.

- To help potential clients get approval from their internal team.

Conclusion

Invoices and proforma invoices are different and serve a unique purpose. It is not only important for you to understand the differences between these two documents, but it is also beneficial for your relationship with your clients if you do. Utilizing both invoices and proforma invoices appropriately can streamline your billing processes and position your business for success.