In the world of international transactions, purpose codes and BriskPe’s innovations are revolutionising global finance, streamlining compliance and enhancing efficiency

In today’s interconnected global economy, cross-border transactions have become a common occurrence, involving the exchange of goods, services, and funds between different countries. However, to ensure transparency, compliance with regulations, and efficient monitoring, financial institutions and central banks require a system for categorising these transactions accurately. This is where ‘Purpose Codes’ come into play. Purpose codes are four-digit alphanumeric identifiers used to specify the nature of cross-border transactions, and they hold paramount importance in ensuring a seamless and accountable international financial system. In this comprehensive article, we will delve into the world of purpose codes, understand their significance, and explore how they affect cross-border transactions, with a focus on India’s regulatory framework.

Understanding Purpose Codes

Purpose codes are standardised alphanumeric codes, typically composed of four characters, designed to communicate the primary purpose or nature of a cross-border transaction. They serve as a crucial tool for financial institutions, governments, and regulatory bodies to categorise and record these transactions accurately. Purpose codes enable the systematic and efficient processing of international transfers and help ensure compliance with the relevant financial regulations.

The Importance of Purpose Codes

1. Regulatory Compliance:

The primary reason for the existence of purpose codes is to facilitate regulatory compliance. Different countries have their own sets of rules and regulations governing cross-border transactions. The central bank of each nation plays a pivotal role in overseeing these transactions and requires detailed information to ensure compliance with its policies.

In India, the Reserve Bank of India (RBI) and the Foreign Exchange Management Act (FEMA) are responsible for governing remittances and foreign transactions. To ensure seamless processing of remittances, it is imperative to specify the purpose of the transaction using the appropriate purpose code. This not only satisfies regulatory requirements but also streamlines the transfer process.

2. Accurate Categorisation:

Purpose codes offer a structured way to categorise cross-border transactions according to their nature. This categorisation helps financial institutions, central banks, and regulators maintain a clear record of international financial activities. This, in turn, enables a better understanding of the flow of funds and the impact of cross-border transactions on the economy. For instance, purpose code P0101 is used in India for the export of goods, while P0202 is employed for the import of services. When these purpose codes are consistently and correctly used, it becomes easier for authorities to track and understand the flow of goods and services across borders.

3. Statistical Analysis:

Purpose codes are a valuable resource for generating statistical data related to cross-border transactions. Regulatory bodies, including the RBI in India, utilise purpose codes to compile and analyse data that can inform policy decisions, monitor economic trends, and evaluate the effectiveness of existing regulations. By using purpose codes, central banks and government agencies can gain insights into which sectors of the economy are most active in international trade, identify trends, and make data-driven decisions to support economic growth and stability.

Determining the Appropriate Purpose Code

Choosing the right purpose code for a cross-border transaction is crucial. The code selected should accurately represent the nature of the transaction to ensure regulatory compliance and efficient processing. Financial institutions are well-equipped to provide guidance on selecting the appropriate purpose code based on the specific details of the transaction.

To illustrate, suppose you are an Indian exporter shipping goods to a foreign buyer. In this case, you would use purpose code P0101 to denote the export of goods. Alternatively, if you are importing services from abroad, purpose code P0202 would be applicable. The key is to align the chosen code with the nature of the transaction, as this code will guide the entire process, from regulatory compliance to statistical analysis.

Purpose codes are an integral part of the global financial landscape, ensuring transparency, compliance, and efficiency in cross-border transactions. While their importance is evident in India’s regulatory framework, they are equally relevant on a broader international scale. As the world becomes increasingly interconnected, the use of purpose codes will continue to play a pivotal role in maintaining the integrity of the global financial system.

The Evolving Landscape

As technology and globalisation continue to advance, the landscape of cross-border transactions is also evolving. The use of purpose codes will remain critical to ensuring the orderly flow of funds and maintaining financial transparency. However, it’s important to note that some regions are exploring innovative approaches to streamline international transactions further.

For instance, advanced solutions are being tested as a means to automate and verify cross-border payments, reduce the need for manual input of purpose codes. They can record transaction details online, making it easier for regulators and financial institutions to access information. While purpose codes will still play a role in identifying the nature of transactions, such innovative solutions has the potential to enhance accuracy and efficiency in cross-border transactions.

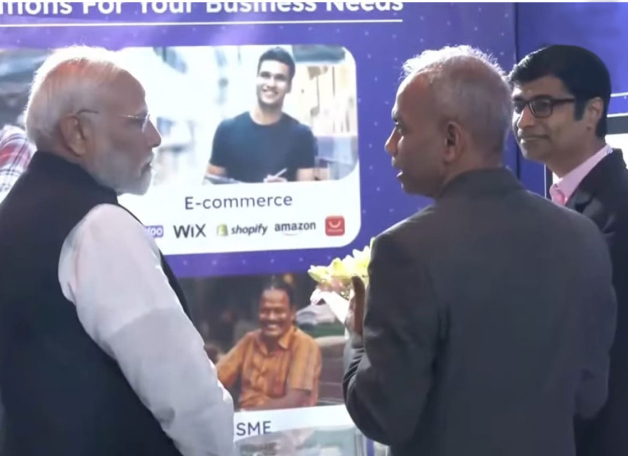

BriskPe’s Unique Value Proposition

Amid this journey, BriskPe emerges as an unparalleled partner. With a commitment to simplifying cross-border transactions, BriskPe offers a suite of advantages that set it apart:

Local Virtual Accounts: BriskPe allows exporters to receive their export remittances directly in a local virtual account, streamlining the process and minimizing costs. This innovative approach eliminates the need for complex routing and reduces the time it takes for funds to reach their destination.

Competitive Exchange Rates: By offering better currency exchange rates, BriskPe enhances profitability for businesses, irrespective of their size. Whether you are a multinational corporation or a small enterprise, every fraction of a percent in exchange rate improvement can translate into significant savings.

Free FIRA (Foreign Inward Remittance Advice) Certificate: BriskPe’s revolutionary approach offers Free FIRA certificates for all payments, simplifying the compliance process. This not only reduces costs but also ensures that businesses can easily demonstrate their compliance with regulations, providing peace of mind for both senders and recipients.

In a world where the global economy relies on the smooth flow of funds across borders, purpose codes and innovative services like those offered by BriskPe play a pivotal role in simplifying the complexities of international finance. As technology continues to evolve, we can expect that the landscape of cross-border transactions will become even more seamless and efficient, benefitting businesses and individuals alike. To know more about BriskPe schedule a call with us.