As Indian businesses expand globally, the need for efficient cross-border payments has become critical. However, traditional payment systems are often slow, expensive, and complicated. High fees and extended wait times have been significant barriers for both businesses and individuals looking to receive international payments.

BRISKPE aims to transform this experience. With our innovative platform, receiving payments from abroad becomes faster, more affordable, and incredibly user-friendly. Whether you’re a business owner, freelancer, or solopreneur, BRISKPE ensures your funds reach you within 24 hours, while keeping transaction fees under 1% (including GST).

In this guide, we’ll break down how BRISKPE works and how it can streamline your cross-border payments.

Why Choose BRISKPE for Cross-Border Payments?

Businesses face several obstacles when managing cross-border payments, including delays, hidden fees, and poor exchange rates. BRISKPE is designed to solve these challenges by offering:

1. Swift and Secure Transfers

International transactions can often take days or even weeks. With BRISKPE, businesses and freelancers can receive funds within 24 to 48 hours. This rapid turnaround improves cash flow, giving you more time to focus on growing your business and less time worrying about payment delays.

2. Cost-Effective Solutions

Most cross-border payment platforms charge significant fees, cutting into your profits. BRISKPE offers highly competitive transaction fees, charging less than 1% (including GST) per transaction. This allows you to save more on every international payment, directly benefiting your bottom line.

3. User-Friendly Interface

Our intuitive, mobile-friendly platform is perfect for businesses and freelancers on the go. The app provides real-time notifications, tracking features, and an easy-to-navigate dashboard. With BRISKPE, you can effortlessly manage your payments, check transaction histories, and monitor your cash flow anytime, anywhere.

4. Optimized Currency Exchange Rates

Using advanced Currency Cloud technology, BRISKPE helps you get the best exchange rates available. Our system analyzes the forex market in real time and can suggest optimal times for currency conversion, so you receive more value for your payments without worrying about unfavourable rates.

How BRISKPE Works: A Step-by-Step Guide

BRISKPE is built with simplicity in mind. Whether you’re new to international payments or a seasoned exporter, our platform makes it easy to get started. Here’s how you can use BRISKPE:

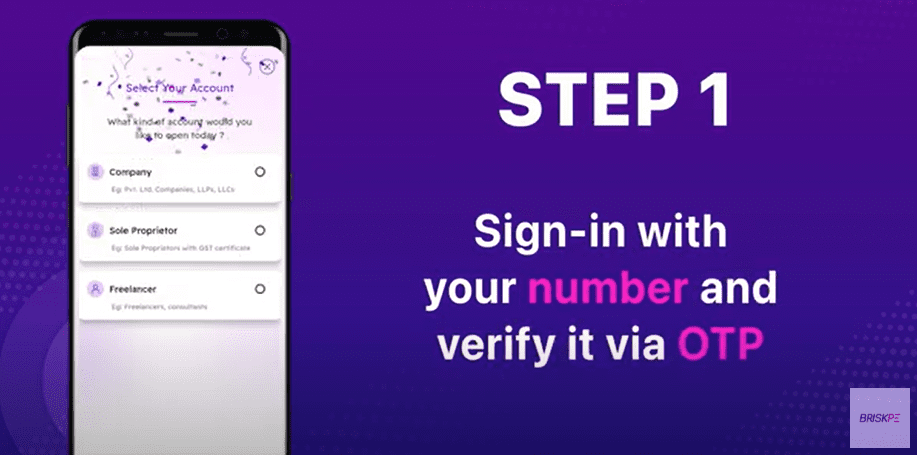

How to Set up Your Account

- Visit the Google Play Store or AppStore to download the BRISKPE app or or sign up on our website.

- Sign in using your mobile number and verify it with an OTP.

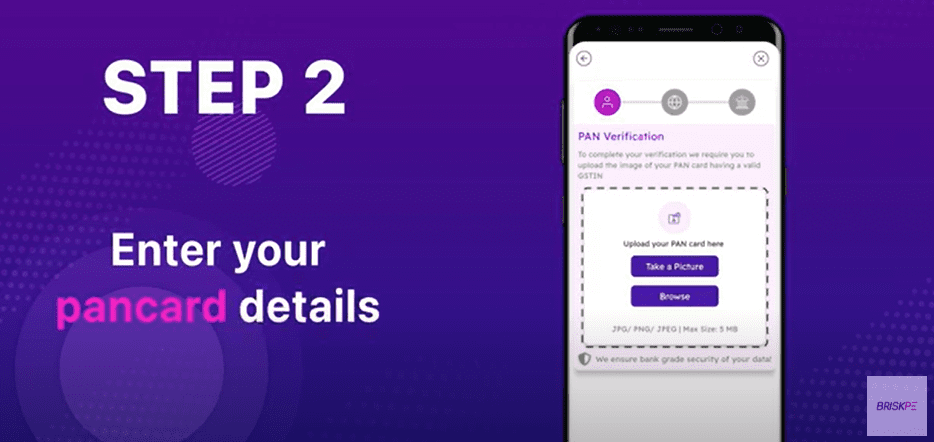

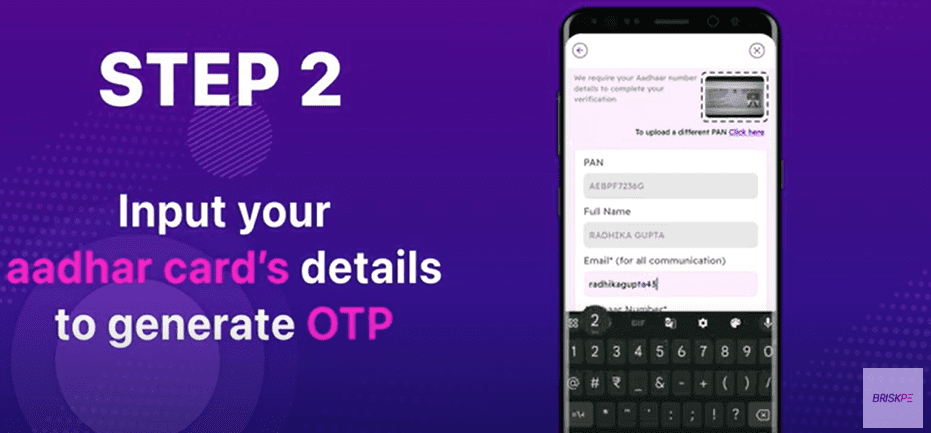

- Complete the KYC process to verify your identity. This includes PAN card verification and Aadhar card verification.

- You’ll receive an OTP on Aadhar-linked phone number which you need to enter to verify your personal details.

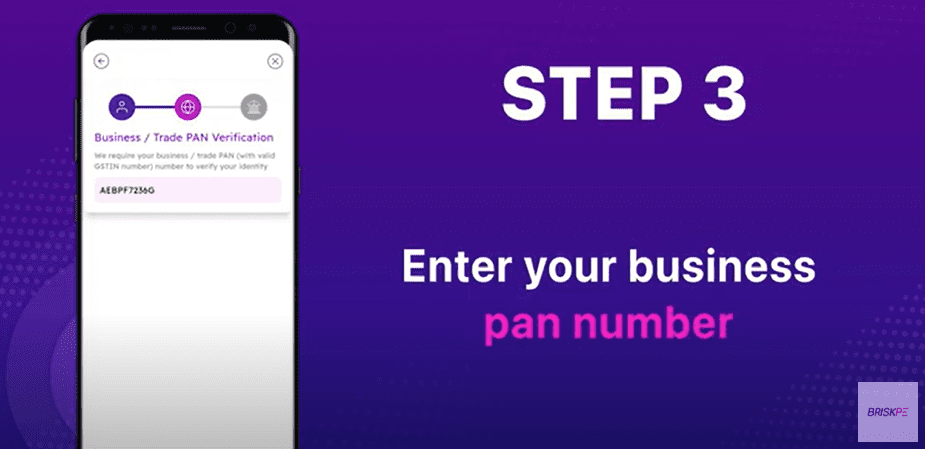

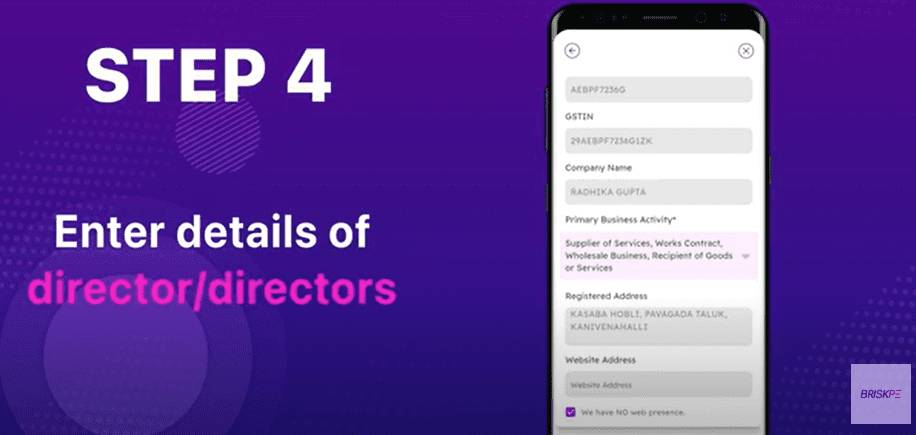

- The next step is to enter your business PAN number and details such as company name and GST number.

Enter details of directors

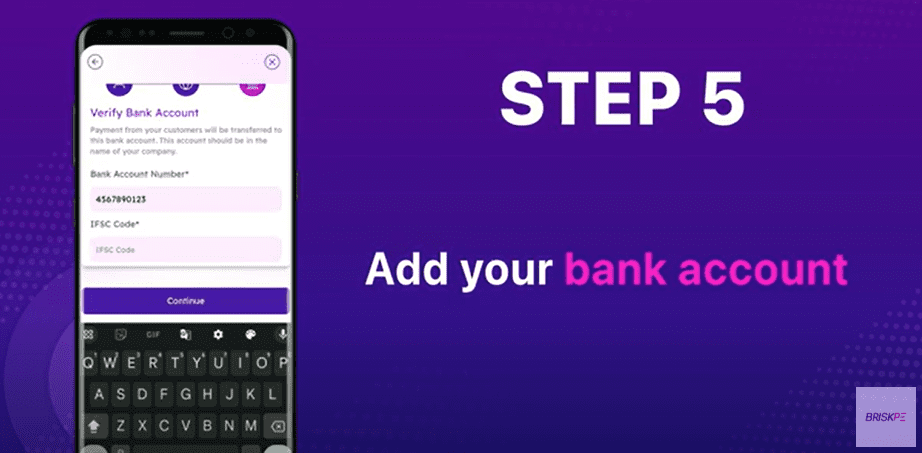

- Lastly, enter your bank account number and you’re all set to transact with BRISKPE.

Payment Requests

- Login to the BRISKPE app or web portal.

- Navigate and click on ‘Request Payment’.

- Add the details of the payer.

- Upload your invoice and description.

- Press on “Proceed” to send payment request to the payer.

Advantages of Using BRISKPE

If you’re a freelancer or a solopreneur providing goods and services internationally then we can help you save a significant amount on your international funds transfer. You can also check the competitive exchange rates through our app.

In addition to all this, a business can benefit in terms of reduction in operational cost, cashflow management, and simplifying finance management.

In simpler words, we can help you with:

- Faster payment process i.e., you can receive payments within 24 hours.

- Pay transfer fee as low as 1% (including GST).

- Get instant e-FIRA.

- Get instant notification about your funds on our app.

- We also offer competitive exchange rates that can help you save more money.

BRISKPE—Redefining Cross-Border Payments

BRISKPE is on a mission to revolutionize cross-border payments for Indian businesses and freelancers. With our platform, you can enjoy fast transactions, lower fees, no hidden forex charges, and an easy-to-use mobile app.

As global trade and services continue to grow, the demand for efficient and affordable international payment solutions will only increase. BRISKPE is ready to lead the charge in making cross-border transactions seamless, transparent, and cost-effective.

If you’re looking for a solution that saves time and money, BRISKPE is your trusted partner in cross-border payments. Experience ease and efficiency today—choose BRISKPE for your international payment needs.