The Bank Realisation Certificate (BRC) is a vital document in international trade and plays a crucial role in verifying export proceeds and ensuring compliance

In the world of international trade, effective documentation systems are critical to guaranteeing seamless transactions and regulatory compliance. In today’s global economy, money is continuously travelling across national borders. Businesses and individuals frequently make and receive overseas payments, thus it is critical to grasp the fundamentals of the paperwork and certifications involved in the process. Let’s explore the importance and functioning of one such crucial document, the Bank Realisation Certificate (BRC).

What is BRC?

Bank Realisation Certificate (BRC) is a certificate issued by the bank to an exporter when they receive payments in return. Essentially, it authenticates foreign exchange revenues credited to the exporter’s bank accounts. In simple words, it serves as a proof that an exporter has received payment for goods and services exported from India. The BRC contains details such as the exporter’s name, exporter’s bank details, invoice details, foreign buyer’s details, foreign exchange details and the amount in Indian rupees.

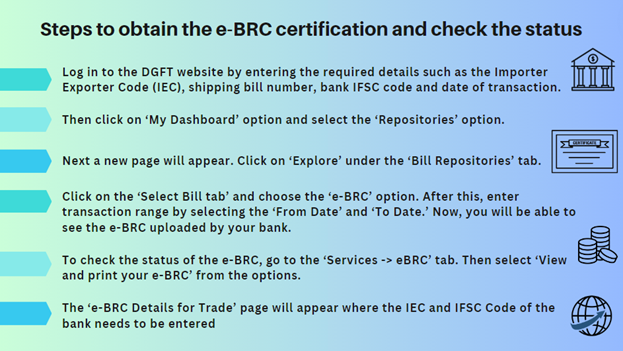

The e-BRC is a digital version of the certificate. The introduction of e-BRC put an end to the time-consuming preparation of going to the bank to get the certificate issued followed by submitting it by going to the Directorate General of Foreign Trade’s (DGFT) regional branch. Presently, banks naturally issue a computerised e-BRC when the exporter applies for the certificate and receives installments for exporting goods and services in the bank account from abroad.

Let’s take a look at why the BRC is a significant document for exporters:

- Ensuring Compliance – In order to comply with the RBI regulations, exporters are required to provide BRC as a proof of realisation of the export proceeds. This helps in ensuring regulatory compliance and reduces the risk of penalties for non-compliance.

- Exchange management – For efficient foreign exchange management, it is essential to accurately document the export earnings. The BRC makes it easy to record and track the inflows and outflows of foreign exchange. This helps in better management of foreign exchange transactions.

- Transparency and accountability – By providing a clear record of the export proceeds, the BRC improves accountability in global trade transactions. It gives stakeholders, including regulators and financial institutions, a clear view of the flow of the foreign exchange earnings.

Why does the RBI need it?

The Reserve Bank of India is the authority figure for all state co-operative, urban co-operative and commercial banks. It requires the BRC to primarily monitor and regulate foreign exchange transactions. Monitoring the inflow of foreign exchange in the country is crucial information for maintaining the stability of the currency and managing the country’s balance of payments. The RBI not only governs international money transfers by keeping track of inflows and outflows of capital, but also monitors the deals by businesses and individualities to understand the nature of significances and exports in the country. It also helps in tracking any illegal or unknown activities in imports and exports, such as smuggling, creation of black markets, money laundering etc.

How is a BRC issued?

There are three key tools and key resources to obtaining a BRC. These include receiving guidance on the documents required and steps involved from the bank, the e-BRC portal which is the primary platform to apply for and obtain the certificate as it discloses user manuals and guidelines for the exporters; alternatively you can access the portal through the DGFT website and lastly, export documentation software tools which can help in assisting e-BRC DGFT submissions and complying the required documents efficiently.

For a BRC, the exporter can approach their banks after they receive money from overseas after a shipment and yield the confirmation of trade. You can get a Foreign Inward Remittance Certificate (FIRC) from the bank when you get instalments from universal clients for sending out goods and services. This document, along with a receipt for the export and a charge for shipped goods, permits you to get a Bank Realisation Certificate (BRC) from the bank. But an important note to be taken is that you have a time restraint of six months from when you get the settlement to get the FIRC and BRC to dodge penalties or complications.

To ease out the process, here is a list of documents that you would require to get a BRC issued:

- Business Name and Address proof

- IEC (Importer Exporter Code)

- Shipping Bill for all export transactions

- Details of the bank account in which the exporter has received the payment

Summing Up

To sum it up, BRC is a vital component of export paperwork, providing exporters with a simplified and efficient process for confirming foreign exchange revenues. It not only validates export proceeds but also supports regulatory compliance, trade data analysis and policy formulation by the Reserve Bank of India (RBI). It is mandatory for an exporter receiving payments for the export to apply for e-BRC and ensure that the bank transfers it on the DGFT site. Exporters can submit their bank realisation certificates to enjoy the benefits of different export incentives like import duty exemptions, customs rebates, or even financial help from the government or other agencies.

As an exporter however, you need to keep proper records of your exports and export related documents to make it easier for you to apply for BRC. Since the rules and procedure may change from time to time, it is important to keep up with the latest updates from official government bodies and industry bodies.